Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Non-resident individuals Types of income Rate.

. In Malaysia 2016 Reach relevance and reliability. This applies to tax residents earning chargeable income above RM400000. On the First 5000 Next 15000.

A2 Changes in tax rates. Tax Rate of Company. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs.

Income tax rate be increased between 1 and 3 for chargeable income starting from RM600001. Tax Rate of Company. From 25 to 28.

Tax at Malaysian tax rate of 24 2016 24 1496241 1137984 1504650 1103314 Non from FAR BKAR2023 at Northern University of Malaysia. The Malaysian Governments budget for 2014 stated that the corporate income tax rate in Malaysia would be reduced to 24 per cent in 2016 from the rate of 25 per cent that had prevailed since 2009. However the tax rate for the other income brackets remain the same.

Chargeable Income Calculations RM Rate TaxRM 0 2500. Refer to the infographic below to check how much your tax rate. To institute a more progressive tax structure with effect from 2016 it has been proposed that two new chargeable income bands.

Information on Malaysian Income Tax Rates. Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016. Chargeable Income RM Previous Rates Current Rates Increase 600001 1000000 25 26 1 Above 1000000 25 28 3 Non-resident individual taxpayer.

Such SMEs must not be part of a group of companies where any. Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. Malaysia tax rate on rental income for foreigners does not take account of the type of visa pass.

The reduction aimed at reducing the cost of doing business in Malaysia and in turn encouraging more investment in the country by attracting foreign. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate 11 Business environment.

Rate TaxRM A. Assessment Year 2016 2017 Chargeable Income. Following the tabling of Budget 2016 it was announced that high income earners who are earning more than RM1 million per annum will be charged 28 income tax which is an increase of 3 from the previous year.

On the First 2500. 25 percent 24 percent from year of assessment ya 2016 special tax rates apply for companies resident in malaysia with an ordinary paid-up share capital of myr 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary paid- up share capital of the company is. YA 2016 onwards Changes to Tax Relieves.

Income tax rate be increased from 25 to 28. On the First 2500. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary.

Resident SMEs with a paid-up capital in respect of ordinary shares of RM25 million and below at the beginning of the basis period for a year of assessment are taxed at a preferential tax rate of 18 instead of the normal rate of 24 for the first RM500000 of its chargeable income. Company Taxpayer Responsibilities. Individual income tax rates Proposed changes for 2016 Currently the highest marginal tax rate for an individual in Malaysia is 25.

Company with paid up capital not more than RM25 million. Other income is taxed at a rate of 26 for 2014 and 25 for 2015. Individual income tax rates are increased.

Calculations RM Rate TaxRM 0 - 5000. Tải bản đầy đủ pdf 102 trang Trang chủ. Textbook Solutions Expert Tutors Earn.

Malaysia January 7 2016 The Prime Minister and Minister of Finance YAB Dato Seri Mohd. Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non-residents are subject to withholding taxes on certain types of income. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

On the First 5000.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

Malaysian Personal Income Tax Pit 1 Asean Business News

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

8 The Goods And Services Tax And State Taxes Treasury Gov Au

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Raises Minimum Wage To Enhance Automated Production

Malaysia Payroll And Tax Activpayroll

Income Tax Formula Excel University

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

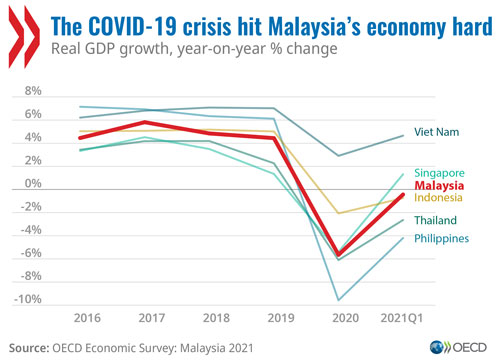

Malaysia Further Reforms To Boost Business Dynamism Would Strengthen The Recovery From Covid 19 Says Oecd

Malaysia Tax Revenue 1980 2022 Ceic Data

What Exactly Is The Alternative Minimum Tax Amt

Expat Friendly Taxes In Malaysia International Living Countries

Income Tax Malaysia 2018 Mypf My

- malaysian tax rate 2016

- sip rate of contribution

- madu dan kunyit hitam untuk kanker

- khasiat daun bayam brazil

- keramik lantai kamar mandi terbaru 2019

- cimb transfer time

- seksyen 30 shah alam

- pewarna rambut dark brown

- buah pinggang bengkak

- faktor datang lewat ke tempat kerja

- minggu berapa boleh buat buku merah

- masak lemak daun keledek

- masalah air di selangor

- kalori kuah ayam masak merah

- cara menurunkan darah putih tinggi

- contoh surat rasmi kepada jabatan kerajaan

- kem tentera sungai besi

- menteri sumber manusia 2019

- cara cat kereta 2k

- parcel held by malaysia custom